| January [●], 2018 | Calmare Therapeutics Incorporated, Chief Executive Officer |

TABLE OF CONTENTS

DESCRIPTION OF THEComplaining Minority Stockholders Should Read the Entire Proxy Statement Carefully Prior to Returning Their Proxies CONSENT STATEMENT

As set forth in the Complaining Minority Statement filed by the Complaining Minority Stockholders on December 5, 2017 with the SEC, the Complaining Minority Stockholders are asking you for your written consent as to the following proposals, which the Company strongly believes are not in the best interests of the Company and its stockholders:

PROXY STATEMENTProposal No. 1 Removal of Four of the Five Existing Directors of the Company: This Proposal provides for the removal without cause of the four directors of the five-member Board who are not affiliated with the Minority Complaining Stockholders. As described above (under “Proposal No. 1”) are the reasons that the Company and a majority of the existing Board oppose this proposal.

FORProposal No. 2 Election of Nominees: This Proposal is to elect five nominees of the Complaining Minority Shareholders in case Minority Stockholders’ Proposal 1 is approved. (One of these nominees currently is a director.) The name of each nominee is set forth in the Complaining Stockholders Statement. It can be noted that three of these five persons were members of the Board during part or all of the time for which the Complaining Minority Stockholders are objecting.

Proposal No. 3 Amendment to Bylaws Fixing the Number of Directors: This proposal will fix the number of directors on the Board at five (5) directors.

THE ANNUAL MEETING OF STOCKHOLDERS Proposal No. 4 Amendment to Bylaws Regarding Change in Number of Directors: The Complaining Minority Stockholders are seeking to amend the Company’s Bylaws to require the unanimous vote of all the members of the Board for any amendment by the Board to the Bylaws which would change the number of directors constituting the Board. The Company opposes this proposal for the reasons set forth above under “Proposal No. 4”.

Proposal No. 5 Amendment to Bylaws Regarding Vacancies: The Complaining Minority Stockholders are seeking to amend Section 2.01 of the Company’s Bylaws so that only Calmare stockholders (and not the Board) can fill any vacancies on the Board created as a result of death, resignation, disqualification, removal or otherwise. The Company opposes this proposal for the reasons set forth above under “Proposal No. 5”.

Proposal No. 6 Repeal of Additional Bylaws or Bylaw Amendments: Stockholders are being asked to adopt a resolution which would repeal each provision of the Company’s Bylaws or amendments of the Bylaws that have been adopted after October 10, 2010 (and before the effectiveness of the foregoing Proposals and the seating of the Complaining Minority Stockholders’ Nominees on the Board. There is no disclosure of what provisions this resolution would repeal. The Company opposes this proposal for the reasons set forth above under “Proposal No. 6”.

REASONS TO REJECT THEComplaining Minority Stockholders’ PROPOSALS

The Proposals submitted by the Complaining Minority Stockholders would, among other things, remove all current directors, except for Stan Yarbro, of the Company and replace them with the Complaining Minority Stockholders’ nominees. Doing so would harm the Company because as set forth above, in the Company’s opinion, the Complaining Minority Stockholders’ nominees would not act in the best interests of the Company because they are looking for short-term gains that will harm the Company’s long-term growth. For example, certain Complaining Minority Stockholders have disclosed material non-public information to certain stockholders and the Complaining Minority Stockholders do not have experience selling regulated medical devices. The Complaining Minority Stockholders would abandon the Company’s five-year turnaround plan that is expected to achieve desired results by the end of this calendar year (2018).

The Board strongly believes that the Minority Consent Solicitation is not in the best interests of the Company’s stockholders.

We urge stockholders to reject the Complaining Minority Statement and revoke any consent previously submitted.

Please do not delay. In order to ensure that the Board is able to act in your best interests, please mark, sign, date and return the enclosed GOLD Consent Revocationas promptly as possible.

BACKGROUND OF THE CONSENT SOLICITATION

From March 2012 to present Stan Yarbro has been a director of the Company, and has not opposed any actions of the Board or of the Company during that time.

On June 30, 2017, and as amended on September 21, 2017, the Complaining Minority Stockholders filed their initial statement of ownership on Schedule 13D, reflecting its investment and ownership in the Company.

Also on June 30, 2017, Stanley Yarbro (on behalf of the Complaining Minority Stockholders) sent a letter to the Board expressing concerns regarding the Company. On or about July 14, 2017, Mr. Yarbro followed up with a letter to Calmare management requesting a meeting with the Board to discuss the issues raised in the initial Schedule 13D.

On or about August 11, 2017, Mr. Yarbro, again on behalf of the Complaining Minority Stockholders, presented the Company’s Secretary with Notice of Stockholder Proposal to Nominate Directors for Election at Annual Meeting in accordance with the Company’s Bylaws proposing for nomination a slate of five individuals to serve as directors of the Company.

On or about August 18, 2017, the Company agreed to a meeting between Company management and the Complaining Minority Stockholders to take place on Thursday, August 24, 2017 at the offices of the Company. On the afternoon of August 22, 2017, the Company indicated that the meeting needed to be rescheduled due to unforeseen scheduling conflicts concerning Company operational matters. The Company offered to have a conference call with the Complaining Minority Stockholders at a mutually agreeable time, but the Complaining Minority Stockholders rejected this offer and failed to provide any time at which they were willing to be available.

During this period, Mr. Yarbro made informal requests for a stockholder list, which the Company did not provide. Mr. Yarbro, through counsel, made a formal demand under Section 220 of the General Laws of the State of Delaware to review the stockholder list of the Company.

On October 3, 2017, Mr. Yarbro filed suit in Delaware Chancery Court to obtain the stockholder list. On October 27, 2017, a hearing was held to determine whether Mr. Yarbro was entitled to the stockholder list. The court ordered the Company to deliver the list of stockholders to Mr. Yarbro, and on November 21, 2017, the Company delivered the stockholder list.

On November 22, 2017, the Complaining Minority Stockholders filed their preliminary Minority Consent Statement with the SEC. On December 4, 2017, the Complaining Minority Stockholders filed an amended preliminary Minority Consent Statement in response to comments from the SEC. On December 5, 2017, the Complaining Minority Stockholders filed their definitive Minority Consent Statement, and distributed this Statement on December 5, 2017.

QUESTIONS AND ANSWERS ABOUT THIS CONSENT REVOCATION STATEMENT

Q: Who is making this Consent Revocation Solicitation?

A: The Company’s existing Board of Directors.

Q: What is the Company asking you to do?

A: You are being asked (i) to NOT return any consent card solicited by the Complaining Minority Stockholders and (ii) to revoke any consent that you may have delivered in favor of any of the Minority Proposals by executing and delivering theGOLD Consent Revocation Card as discussed below.

Q: If I have already delivered a consent, is it too late for me to change my mind?

A:NO, it is not too late to change your mind. Until the requisite number of duly executed, unrevoked consents are delivered to the Company in accordance with both the Delaware General Corporation Law (the “DGCL”) and the Company’s organizational documents, the consents will not be effective. At any time prior to the consents becoming effective, you have the right to revoke your consent by executing and delivering aGOLD Consent Revocation Card as discussed in the following questions.

Q:What is the effect of delivering a GOLD Consent Revocation Card?

A: By marking the “YES, REVOKE MY CONSENT” boxes on the enclosedGOLD Consent Revocation Card and signing, dating and mailing the card in the postage-paid envelope provided, you will revoke any earlier dated consent that you may have delivered to the Complaining Minority Stockholders or the Company. Even if you have not submitted a Complaining Minority Stockholders consent card, you may submit aGOLD Consent Revocation Card. Even if you have not previously submitted a Complaining Minority Stockholders consent card, by submitting theGOLDConsent Revocation Card, you will help us keep track of the progress of the consent process.

Q:What is the Board’s recommendation?

A: The Board has determined that the Proposals are not in the best interests of the Company or its stockholders. Accordingly, the Board urges you to reject the Minority proposals and to revoke any consent previously submitted, as described immediately below.

Q:What should I do to revoke my consent?

A: Mark the “YES, REVOKE MY CONSENT” boxes next to each proposal listed on theGOLD Consent Revocation Card. Then,sign and datethe enclosedGOLD Consent Revocation Card and return it TODAY or as soon as possible to the Company’s proxy solicitor, Harkins Kovler, LLC, in the envelope provided. It is important thatyou sign and date the GOLD Consent Revocation Card.

Q:Who is entitled to consent, withhold consent or revoke a previously given consent with respect to the Proposals contained in the Complaining Minority Statement?

A: Only the holders of record of the Shares as of the close of business on November 16, 2017, are entitled to consent, withhold consent or revoke a previously given consent with respect to the Proposals contained in the Complaining Minority Statement. The Company will be soliciting consent revocations from stockholders of record as of the close of business on November 16, 2017, and only holders of record of Shares as of the close of business on November 16, 2017, may execute, withhold or revoke consents with respect to the Consent Solicitation. You may execute, withhold or revoke consents at any time before or after November 16, 2017, provided that any such consent or revocation will be valid only if you were a holder of record of Shares on November 16, 2017, and the consent or revocation was otherwise valid.

Q:When should I return my GOLD Consent Revocation Card?

A:RIGHT AWAY. In order for the Proposals to be adopted, the Company must receive valid, unrevoked consents executed by the holders of a sufficient number of Shares within sixty (60) days of the earliest-dated consent delivered to the Company. Because the Proposals could become effective before the expiration of the sixty (60)-day period, you should promptly return theGOLDConsent Revocation Card.

Q:What happens if I do nothing?

A: If you do not execute and send in any consent that the Complaining Minority Stockholders sent you, you will effectively be voting AGAINST the Proposals. Even if you have not consented to the Minority Proposals, we would prefer that you submit aGOLD Consent Revocation Card to help us keep track of the progress of the consent process.

If you have validly executed and delivered a consent card that the Complaining Minority Stockholders sent you, doing nothing further will mean that you have consented to the Complaining Minority Stockholders’ Proposals, which means you will effectively be voting FOR the Minority Proposals. If you have executed and delivered a consent card that the Complaining Minority Stockholders sent you, the Board urges you to revoke any such consent previously submitted by executing and delivering theGOLD Consent Revocation Card.

Q:Who should I call if I have questions about the solicitation?

A: If you have any questions regarding this Consent Revocation Statement or about submitting yourGOLD Consent Revocation Card, or otherwise require assistance, please call or contact the Company’s proxy solicitor:

Harkins Kovler, LLC

1 Rockefeller Plaza

10thFloor

New York, NY 10020

Telephone: +1 (212) 468-5380

FAX: +1 (212) 468-5381

Email: cttc@harkinskovler.com

THE CONSENT PROCEDURE

Voting Securities and Record Date

The Company does not believe the Complaining Minority Stockholders have followed the appropriate procedures to establish November 16, 2017 as the record date. However, the Company will seek consent revocations for all stockholders of record as of the close of business on November 16, 2017, for the determination of the Company’s stockholders who are entitled to execute, withhold or revoke consents relating to the Proposals. This is not an agreement to November 16, 2017 as the appropriate record date by the Company. As of the close of business on November 16, 2017, there were 30,376,639 Shares outstanding, each entitled to one vote per Share. Only record holders of Shares as of the close of business on November 16, 2017, are eligible to execute, withhold or revoke consents in connection with the Minority Consent Solicitation and this Consent Revocation Statement. Persons beneficially owning Shares through a broker, bank or other nominee, should contact such broker, bank or other nominee and instruct it to execute theGOLD Consent Revocation Card on their behalf. You may execute, withhold or revoke consents at any time before or after November 16, 2017, provided that any such consent, withholding or revocation will be valid only if you were a holder of record of Shares on the proper record date and the consent or revocation is otherwise valid.

Effectiveness of Consents

Under the DGCL, unless otherwise provided in a corporation’s certificate of incorporation, stockholders may act without a meeting, without prior notice and without a vote, if consents in writing setting forth the action to be taken are signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. The Company’s certificate of incorporation does not prohibit stockholder action by written consent. To be effective, the Proposals require consents signed by stockholders representing a majority of the Shares outstanding as of the close of business on the proper record date.

Furthermore, under Section 228 of the DGCL, all consents will expire unless valid, unrevoked consents representing at least a majority of the Shares outstanding as of the proper record date are delivered to the Company within sixty (60) days of the earliest-dated consent delivered to the Company.

Because the Proposals contained in the Complaining Minority Stockholders Consent Statement could become effective before the expiration of the sixty (60)-day period set forth in Section 228 of the DGCL, WE URGE YOU TO ACT PROMPTLY TO RETURN THEGOLD CONSENT REVOCATION CARD.

Effect of GOLD Consent Revocation Card

A stockholder may revoke any previously signed consent bycompleting, signing, datingandreturningto the Company aGOLD Consent Revocation Card. Technically a consent also may be revoked by delivery of a written revocation of your consent to the Complaining Minority Stockholders. However, to assure proper tabulation and recording, stockholders are urged to deliver all consent revocations to the Company, c/o Harkins Kovler, LLC, 1 Rockefeller Plaza, 10th Floor, New York, NY 10020. The Company requests that if a revocation is instead delivered to the Complaining Minority Stockholders, a copy of the revocation also be delivered to the Company, c/o Harkins Kovler, LLC, at the address set forth in the preceding sentence, so that the Company will be aware of all revocations.

Unless you specify otherwise, by signing and delivering theGOLD Consent Revocation Card, you will be deemed to have revoked consent to all of the Minority Proposals.

Any consent revocation may itself be revoked by marking, signing, dating and delivering a written revocation of yourGOLD Consent Revocation Card to the Company or to the Complaining Minority Stockholders or by delivering to the Complaining Minority Stockholders a subsequently dated consent card that the Complaining Minority Stockholders sent to you.

The Company has retained Harkins Kovler, LLC to assist in communicating with stockholders in connection with the Complaining Minority Stockholders Consent Solicitation and to assist in our efforts to obtain consent revocations. If you have any questions regarding this Consent Revocation Statement or about submitting yourGOLD Consent Revocation Card, or otherwise require assistance, please call Harkins Kovler, LLC at +1 (212) 468-5380.

You are urged to carefully review this Consent Revocation Statement. YOUR TIMELY RESPONSE IS IMPORTANT. You are urged NOT to sign any consent cards sent by the Complaining Minority Stockholders. Instead, the Company urges you to reject the solicitation efforts of the Complaining Minority Stockholders by promptly completing, signing, dating and mailing the enclosed GOLD Consent Revocation Card to Harkins Kovler, LLC, 1 Rockefeller Plaza, 10th Floor, New York, NY 10020. Please be aware that if you sign a consent card sent by the Complaining Minority Stockholders but do not check any of the boxes on the card, you will be deemed to have consented to all of the Minority Proposals in the Complaining Minority Statement.

Results of the Complaining Minority Stockholders Statement

The Company will retain an independent inspector of elections in connection with the Complaining Minority Stockholders Consent Solicitation. The Company intends to notify stockholders of the results of the Complaining Minority Statement by issuing a press release, which it also will file with the SEC as an exhibit to a Current Report on Form 8-K.

SOLICITATION OF CONSENT REVOCATION

Cost and Method

The cost of the solicitation of consent revocations will be borne by the Company. The Company estimates that the total expenditures relating to the Company’s solicitation of consent revocations (other than salaries and wages of officers and employees) will be approximately $[●], of which approximately $[●] has been spent as of the date hereof. In addition to solicitation by mail, directors, officers and other employees of the Company may, without additional compensation, solicit consent revocations in person, or by telephone, facsimile, email, internet, text messaging, or other forms of electronic communication.

The Company has retained Harkins Kovler, LLC as proxy issolicitors, at a fee estimated not to exceed $[●], plus reasonable out-of-pocket expenses, to assist in this solicitation of revocations. In addition to the use of the mails, revocation requests may be solicited by Calmare by facsimile, telephone, email and other electronic channels of communications, in-person discussions and by advertisements. Harkins Kovler, LLC will also assist Calmare in Calmare’s communications with its stockholders with respect to the Consent Revocation Statement and such other advisory services as may be requested from time to time by Calmare. The Company will reimburse brokerage houses, banks, custodians and other nominees and fiduciaries for out-of-pocket expenses incurred in forwarding Calmare’s Consent Revocation Statement materials to, and obtaining instructions relating to such materials from, beneficial owners of the Shares. In addition, Harkins Kovler, LLC and certain related persons will be indemnified against certain liabilities arising out of or in connection with the engagement. Harkins Kovler, LLC has advised the Company that approximately [●] of its employees will be involved in the solicitation of revocations by Harkins Kovler, LLC on behalf of the Company.

Participants in the Company’s Solicitation of Consent Revocations

Under applicable regulations of the SEC, four of the Company’s five directors and the two executive officers of the Company are deemed “participants” in the Company’s Consent Revocation Statement. Please refer to Appendix A for information about our directors and executive officers who may be deemed to be participants.

APPRAISAL RIGHTS

Holders of Shares do not have appraisal rights under the DGCL in connection with this solicitation of consent revocations.

CURRENT DIRECTORS OF THE COMPANY

Conrad Mir, 49, has been a director, President and Chief Executive Officer of the Company since October 2013. He has over twenty years of investment banking, financial structuring, and corporate reengineering experience. He has served in various executive management roles and on the Board of Directors of Calmare Therapeutics Incorporatedseveral companies in the biotechnology industry. From December 2012 until September 2013, Mr. Mir served as the Chief Financial Officer of Pressure BioSciences, Inc., (OTCQB: PBIO), a sample preparation company advancing its proprietary pressure cycling technology. From June 2011 until October 2012, Mr. Mir was Chairman and Chief Executive Officer of Genetic Immunity, Inc., a plasmid, DNA company in the HIV space. From November 2008 until May 2011, Mr. Mir served as Executive Director of Advaxis, Inc., (OTCQB: ADXS), a vaccine biotechnology company. Over the last ten years, he was responsible for use at our annual meeting of stockholdersraising more than $40 million in growth capital and broadening corporate reach to be held at the Princeton Club, NY, NY, on October 15, 2015 at 10:00 a.m. EDT. Voting materials,new investors and current shareholders. Mr. Mir has worked for several investment banks including this proxy statement,Sanford C. Bernstein, First Liberty Investment Group, and the proxy card are being delivered to all or our stockholders on or about September 22, 2015.Nomura Securities International. He holds a BS/BA in Economics and English with special concentrations in Mathematics and Physics from New York University.

QuestionsWe believe Mr. Mir’s qualifications to serve on our Board of Directors include his proven track record in executive management in biotechnology and Answers

Following are some commonly asked questions raised by our stockholdersmedical device companies, capital raising, financial instrument structuring and answers to each of those questions.

What may I vote on at the annual meeting? corporate reengineering.

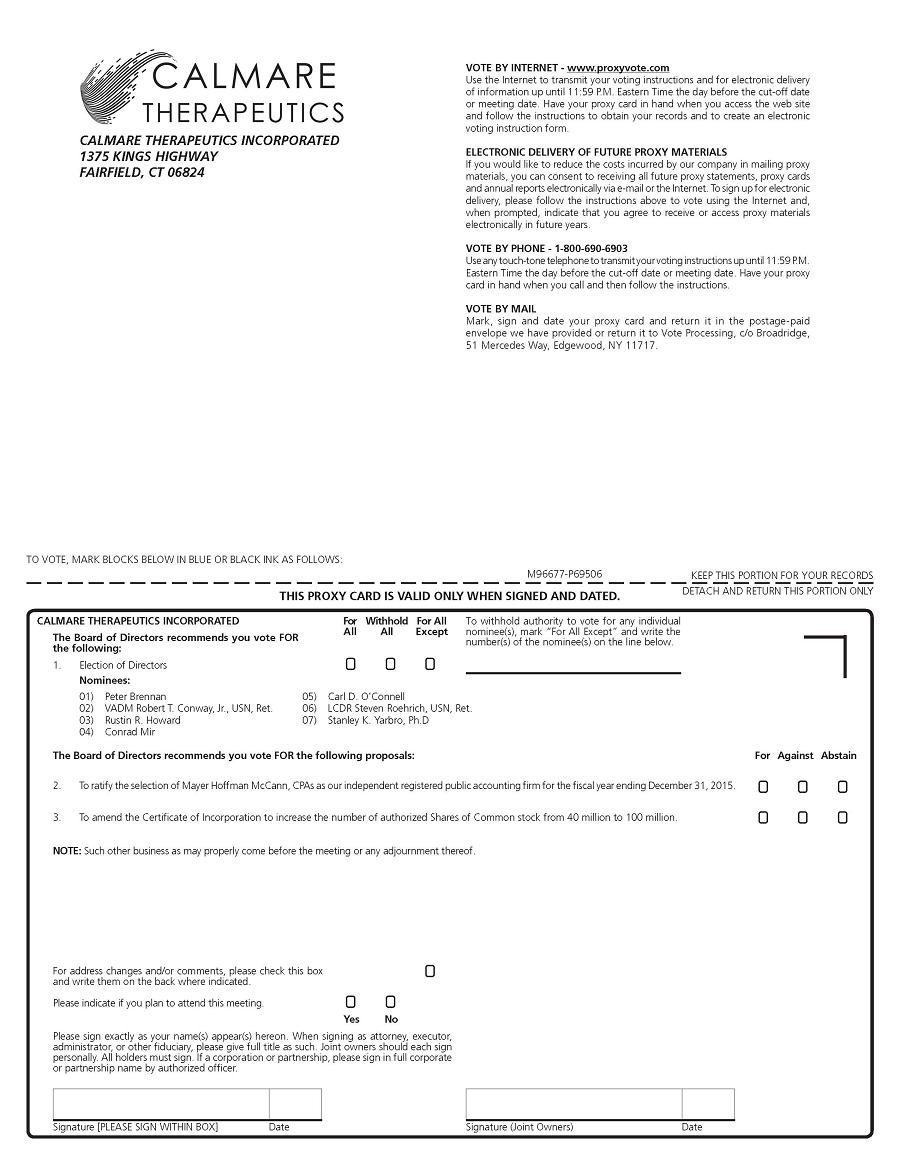

At the annual meeting, stockholders will consider and vote upon the following matters:

| |

|

|

To consider and act upon any other business as may properly come before the annual meeting or any adjournments thereof.

How does the Board recommend that I vote on the proposals?

The Board recommends a vote “FOR” the election of each of the nominees identified below to our Board, “FOR” the proposal ratifying the appointment of Mayer Hoffman McCann, CPAs, and “FOR” the amendment to the Certification of Incorporation to increase the number of authorized shares of Common Stock.

How do I vote?

You can vote either in person at the annual meeting or by proxy, by mail, by phone or over the Internet whether or not you attend the annual meeting. To obtain directions to attend the annual meeting, please call (203) 368-6044. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered the stockholder of record with respect to those shares and we are sending a Notice directly to you. As the stockholder of record, you have the right to vote in person at the annual meeting. If you choose to do so, you may vote at the annual meeting using the ballot provided at the meeting. Even if you plan to attend the annual meeting in person, we recommend that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the annual meeting in person.

Most of our stockholders hold their shares in street name through a stockbroker, bank or other nominee rather than directly in their own name. In that case, you are considered the beneficial owner of shares held in street name and the Notice is being forwarded to you. As the beneficial owner, you are also invited to attend the annual meeting. Because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the annual meeting unless you obtain a “legal proxy” from the stockbroker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. You will need to contact your stockbroker, trustee or nominee to obtain a legal proxy, and you will need to bring it to the annual meeting in order to vote in person.

You can vote by proxy in three ways:

If you vote by proxy, your shares will be voted at the annual meeting in the manner you indicate.

The Internet and phone voting system for stockholders of record will close at 11:59 p.m. EDT on October 14, 2015. Please refer to the proxy card for details on all methods of voting.

What happens if I do not give specific voting instructions?

If you hold shares in your name and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board on all matters. If you hold your shares through a stockbroker, bank or other nominee and you do not provide instructions on how to vote, your stockbroker or other nominee may exercise their discretionary voting power with respect to certain proposals that are considered as “routine” matters.For example, Proposal 2 - ratification of the appointment ofMayer Hoffman McCann, CPAsas our independent registered public accounting firm is commonly considered as a routine matter, and thus your stockbroker, bank or other nominee may exercise their discretionary voting power with respect to Proposal 2.If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on these matters with respect to your shares.This is generally referred to as a “broker non-vote.” When the vote is tabulated for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposal 1 - the election of our Board or with respect to Proposal 3 - Approval of Amendment to Articles of Incorporation to Increase Authorized Shares.We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the notice.

What is the quorum requirement for the annual meeting?

The Company’s bylaws provide that the holders of a majority of the stock issued and outstanding and entitled to vote generally in the election of directors, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum. On September 16, 2015, the Record Date for determining which stockholders are entitled to vote, there were 28,395,880 shares of our common stock outstanding, 2,427 shares of 5% preferred stock, issued and outstanding, and 375 shares of Series C convertible preferred stock, issued and outstanding. Each share of common stock and Series A preferred stock entitles the holder to one vote on matters submitted to a vote of our stockholders. Each share of Series C preferred stock entitles the holder to 1,000 votes on matters submitted to a vote of our stockholders. A majority of our outstanding common shares as of the Record Date must be present at the annual meeting, in person or represented by proxy, in order to hold the meeting and conduct business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the annual meeting, if you are present and vote in person at the meeting or have properly submitted a proxy card or voted by phone or by using the Internet.

How can I change my vote after I return my proxy card?

You may revoke your proxy and change your vote at any time before the final vote at the annual meeting. You may do this by signing a new proxy card with a later date, by voting on a later date by using the Internet (only your latest Internet proxy submitted prior to the annual meeting will be counted), or by attending the annual meeting and voting in person. However, your attendance at the annual meeting will not automatically revoke your proxy unless you vote at the annual meeting or specifically request in writing that your prior proxy be revoked.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our company or to third parties, except:

Any written comments that a stockholder might include on the proxy card will be forwarded to our management.

Where can I find the voting results of the annual meeting?

The preliminary voting results will be announced at the annual meeting. The final voting results will be tallied by our Inspector of Elections and reported in a Current Report on Form 8-K which we will file with the SEC within four business days of the date of the annual meeting.

How can I obtain a separate set of voting materials?

To reduce the expense of delivering duplicate voting materials to our stockholders who may have more than one Calmare Therapeutics Incorporated stock account, we are delivering only one Notice to certain stockholders who share an address, unless otherwise requested. If you share an address with another stockholder and have received only one Notice, you may write or call us to request to receive a separate Notice. Similarly, if you share an address with another stockholder and have received multiple copies of the Notice, you may write or call us at the address and phone number below to request delivery of a single copy of this Notice. For future annual and/or annual meetings, you may request separate Notices, or request that we send only one Notice to you if you are receiving multiple copies, by writing or calling us at:

Calmare Therapeutics Incorporated

1375 Kings Highway East, Suite 400

Fairfield, Connecticut 06824

Tel: (203) 368-6044

What is the voting requirement to approve the proposals?

The proposal to approve an amendment to the Company’s Articles of Incorporation to increase the amount of authorized shares of common stock will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. The proposal to ratify the appointment of Mayer Hoffman McCann, CPAs as our independent registered public accounting firm will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal.

The nominees for election to our Board are elected by a plurality of all votes cast by holders of our Common Stock which are issued and outstanding and which are issuable upon conversion of shares of our Preferred Stock, present at the annual meeting, in person or represented by proxy, and entitled to vote on the election of directors. A nominee who receives a plurality means that he has received more votes than any other nominee for the same director’s seat. Abstentions and broker non-votes will have no impact on the outcome of the vote on the election of directors.

Abstentions and broker non-votes will be treated as shares that are present, or represented and entitled to vote for purposes of determining the presence of a quorum at the annual meeting. Abstentions will not be counted in determining the number of votes cast in connection with any matter presented at the annual meeting. Broker non-votes will not be counted as a vote cast on any matter presented at the annual meeting.

Do I Have Dissenters’ (Appraisal) Rights?

Appraisal rights are not available to our shareholders with any of the proposals described above to be brought before the annual meeting of shareholders.

How can I obtain additional information about the Company?

We are subject to the informational requirements of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, which requires that we file reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding companies, including Calmare Therapeutics Incorporated that file electronically with the SEC. The SEC’s website address is www.sec.gov. In addition, our filings may be inspected and copied at the public reference facilities of the SEC located at 100 F Street, N.E. Washington, DC 20549; and at the SEC’s regional offices at 233 Broadway, New York, NY 10279 and Citicorp Center, 500 West Madison Street, Room 1400, Chicago, IL 60661. Copies of the material may also be obtained upon request and payment of the appropriate fee from the Public Reference Section of the SEC located at 100 F Street, N.E., Washington, DC 20549.

Who Can Help Answer Your Questions?

If you have any questions or need assistance in voting your shares, you may seek answers to your questions by writing, calling, or emailing us at:

Calmare Therapeutics Incorporated

Attention: Ian Rhodes, CFO

1375 Kings Highway East, Suite 400

Fairfield, Connecticut 06824

Tel: (203) 368-6044

Email: ctt@calmaretherapeutics.com

PROPOSAL 1: TO ELECT OUR BOARD TO HOLD OFFICE UNTIL OUR 2016 ANNUAL MEETING OF STOCKHOLDERS OR UNTIL THEIR RESPECTIVE SUCCESSORS HAVE BEEN DULY ELECTED AND QUALIFIED

INFORMATION ABOUT DIRECTOR NOMINEES

At the annual meeting, seven directors are to be elected. Each director is to hold office until the next annual meeting of shareholders or until his successor is elected and qualified. Set forth below are descriptions of the backgrounds of the director nominees of the Company, their principal occupations for the past five years, and the specific experience, qualifications and other attributes and skills that led the Board to determine that such persons should be re-elected to serve on the Board.

Peter Brennan,60,,CFA,62, has been a director of ourthe company since June 2011. PeterMr. Brennan MBA, CFA is a New York based investor who has worked over 30 years in the investment management business as an analyst and portfolio manager. In 2004 Mr. Brennanhe founded Damel Investors LLC, a private partnership which invests in small technology companies. Mr. Brennan received his MBA from the University of Chicago in 1979 and his BA from Haverford College in 1977. He is a member and past Chairman of the Corporate Governance Committee of the New York Society of Security Analysts and received the 2001 Volunteer of the Year award from the NYSSA. Mr. Brennan was a member of the US Advocacy Committee of the CFA Institute and was a founding member of the Capital Markets Policy Council of the CFA Institute for Market Integrity, the global advocacy committee of the CFA Institute.

We believe Mr. Brennan’s qualifications to serve on our Board of Directors include expertise in working with small medical device companies as well as his experience in the investment community and as an investor in the pharmaceutical, medical device and health care industries.

Rustin R. Howard,58,61, has been a director of ourthe company since October 2007. Mr. Howard is the chairman of the Board of Directors of Deep Gulf, Inc., which builds underwater pipelinesenergy transportation systems and associated facilities in deep and ultra-deep offshore oil and gas production fields. Additionally, he is a principalto serve niche economies. Mr. Howard also serves on the Board of Whitesand Investments LLC, an “Angel investment” organization, and a co-owner and officerDirectors of Silver Bullet Technology.Technology, Inc. Silver Bullet, Technology, where he has been primarily responsible for corporate and financial oversight as well as strategic planning, manufacturesbuilds and sells software for the banking and payment processing industry. In 1990, he founded and served as CEOChief Executive Officer and Chairman of the Board of Directors of Phyton, Inc., athe world leader in the use of proprietary plant cell fermentation technology, including thethat is used for production of paclitaxel, the active ingredient of Bristol-Myers Squibb’s (NYSE:BMY) multi-billion dollar anticancer drug, Taxol®. Phyton was sold to DFB Pharmaceuticals, Inc. in 2003. Previously, Mr. Howard served as presidentPresident and CEOChief Executive Officer of BioWorks Inc., a biotechnology company he founded to develop, produce, and sell products that replace chemical pesticides. Mr. Howard earned his MBA from Cornell University’s Johnson Graduate School of Management, where he focused his studies on entrepreneurship, and managing innovation and technology.

We believe Mr. Howard’s qualifications to serve on our Board of Directors include his expertise in biotechnology and product development as well as his experience in technology and high-growth business development.

Conrad Mir, age 46, has been a director, president and CEO since October 2013, he has over twenty years of investment banking, financial structuring, and corporate reengineering experience. He has served in various executive management roles and on the Board of Directors of several companies in the biotechnology industry. Most recently, Mr. Mir was the chief financial officer of Pressure BioSciences, Inc., (OTCQB: PBIO), a sample preparation company advancing its proprietary pressure cycling technology from December 2012 until September 2013. From June 2011 until October 2012, Mr. Mir was chairman and CEO of Genetic Immunity, Inc., a plasmid, DNA company in the HIV space and was executive director of Advaxis, Inc., (NASDAQ: ADXS), a vaccine biotechnology company from November 2008 until May 2011. Over the last seven years, he was responsible for raising more than $40 million in growth capital and broadening corporate reach to new investors and current shareholders.

Mr. Mir has worked for several investment banks including Sanford C. Bernstein, First Liberty Investment Group, and Nomura Securities International. He holds a BS/BA in Economics and English with special concentrations in Mathematics and Physics from New York University.

We believe Mr. Mir’s qualifications to serve on our Board of Directors include his proven track record in executive management in biotechnology and medical device companies, capital raising, financial instrument structuring and corporate reengineering.

Carl D. O’Connell, 51,54, has been a director of ourthe Company since January 2013, having served as presidentits President and CEO sinceChief Executive Officer from November 2012.2012 to September 2013. Mr. O’Connell has 30 years of experience in the healthcare field and 20 years as a leader in the medical device arena. Prior to joining Competitive Technologies,the Company, Mr. O’Connell held executive positions for top global medical device and Fortune 500 companies. He recently served as presidentPresident and CEOChief Executive Officer for the US Healthcare Division MedSurg for ITOCHU, a Japanese conglomerate, vice presidentVice President of global marketingGlobal Marketing for Stryker Spine, and presidentPresident of Carl Zeiss Surgical, the market leader in optical digital solutions for Neurosurgery, Spine, Ophthalmology, ENT and Dentistry.

We believe Mr. O’Connell’s qualifications to serve on our Board of Directors include his proven track record in commercializing medical technologies as well as building effective and profitable sales and distribution organizations.

Stanley K. Yarbro, Ph.D., 65,68, has been a director of our Company since March 2012. Dr.Mr. Yarbro has extensive experience in market development of high technology solutions to a worldwide customer base. He recently retired as executive vice president, worldwide field operations, for Varian Semiconductor Equipment Associates, a position he had held since 2004. Prior to Varian, Dr.Mr. Yarbro served in various executive capacities at KLA-Tencor Corporation, in the semi-conductor industry. He currently serves on the board Carbon Design Innovations and has previously served on the boards of FSI International, Electrogas, Inc. and Molecular Imaging where he worked closely with the organizations to develop and improve sales, product and marketing strategies. Dr.Mr. Yarbro holds a Ph.D. in Analytical Chemistry from Georgia Institute of Technology and a B.S.inB.S. in Chemistry from Wake Forest University.

We believe Dr. Yarbo’s qualificationsAlthough we originally believed that Stanley Yarbro was qualified to serve on our Board of Directors, include his expertisesubsequent actions, some of which are described in market developmentthis Consent Revocation Statement, lead us to believe that his service on the Board is not in the best interests of high technology products and his years of experience as a senior executive and director of various technological and pharmaceutical corporations.

LCDR Steven Roehrich,USN, Ret., 65, is President and CEO of Ready Room, a company that owns and operates light manufacturing companies. The Commander currently serves as an adviser to top leaders at Fortune 500 companies, middle market firms, and federal government departments A7 by helping them adapt to changing global market conditions, capitalize on new technologies, and improve growth and operating performance. The Commander worked at Johnson and Johnson (JNJ) as acorporate Vice President for Business Improvement, reporting to JNJ’s executive committee. The Commander led enterprise-wide business assessment, operational and financial performance reforms across JNJ, focusing on Tylenol, Johnsons, RoC, Aveeno, Acuvue lenses, Janssen, Ortho-McNeil, DePuy brands along with JNJ’s additional consumer, medical device and pharmaceutical sectors' 200 worldwide companies in 175 countries. The Commander served on JNJthe Company and global brand franchise management boards in Europe, Asia and the Americas.

The Commander’s former board memberships include NCR Corporation’s $2 billion Teradata CIO Informatics Group, Northwestern University Kellogg Graduate School of Business Advisory Council, University of Pennsylvania’s Wharton Business School’s Industry Council, and multiple early stage bio-med and technology firms. Prior to the private sector, the Commander was a 21 year career United States Naval Aviator (4300 flight hours), a Viet Nam and Gulf War veteran, aerial combat instructor and Mission Commander holding leadership roles in Navy squadrons and air-wings.

The Commander holds a MS in Financial Management from the US Naval Postgraduate School in Monterey, CA, a BA from Concordia College in Moorhead, MN and Advanced Management education from the Wharton School-University of Pennsylvania in Philadelphia, PA. The Commander completed US Naval Aviation Flight Training in Pensacola, Florida.

We believe the Commander’s qualifications to serve on our Board of Directors include his expertisein executive management in biotechnology companies and high-growth business development. .its shareholders.

VADMRobert T. Conway, Jr., USN, Ret., 65, is the President of R.T. Conway & Associates, Inc. In this position the Admiral provides strategic advice to senior business executives on Navy Programs, Change Management, Facilities and Infrastructure Management, Renewable Energy, Information Technology, Alternative Energy Solutions and Maritime Operations. Previously, the Admiralserved in the United States Navy from 1972 until the Admiral’s retirement in 2009 in various leadership positions aboard USS Vesole (DD 878), USS Towers (DDG 9), USS Bainbridge (CGN 25), and USS Gridley(CG 21). The Admiral commanded USS John Young (DD 73), and also commanded Destroyer Squadron 7 in San Diego; Naval Surface Group Middle Pacific in Hawaii; and Plank Owner of the Navy’s first Expeditionary Strike Group: Expeditionary Strike Group One/PeleliuStrike Group. Ashore, the Admiral served on the Joints Chiefs of Staff, Bureau of Naval Personnel, Operational Test and Evaluation Force Pacific; Officer Candidate School in Newport R.I., and Naval Facility Cape Hatteras in N.C. The Admiral commanded Navy Region Pearl Harbor in Hawaii and Task Force Warrior in Norfolk, Va. In the Admiral’s final assignment, the Admiral served as Commander, Navy Installations Command. Mr. Conway received his master’s degree from Providence University, Providence, R.I. Also, the Admiral is a graduate of the Industrial College of the Armed Forces at the National Defense University, Washington, D.C.

We believe the Admiral’s qualifications to serve on our Board of Directors include his expertiseand years of experience in high growth business development.

Vote Required

The affirmative vote of a plurality of the shares our common stock represented in person or by proxy at the Annual Meeting is necessary for the election of the individuals named above. There is no cumulative voting in elections of directors. Unless otherwise specified, proxies will be voted in favor of the seven nominees described above.

RecommendationNAMED EXECUTIVE OFFICERS OF THE COMPANY

Our Board of Directors recommends that shareholders voteFORConrad Mirthe election of each, 49, has been a director, President and Chief Executive Officer of the individuals named above.

CTI’s Corporate Governance Principles, Corporate CodeCompany since October 2013. He has over twenty years of Conduct, the Committee Charters for the Audit Committeeinvestment banking, financial structuring, and the Nominatingcorporate reengineering experience. He has served in various executive management roles and Corporate Governance Committee ofon the Board of Directors of several companies in the unofficial restated Certificatebiotechnology industry. From December 2012 until September 2013, Mr. Mir served as the Chief Financial Officer of IncorporationPressure BioSciences, Inc., (OTCQB: PBIO), a sample preparation company advancing its proprietary pressure cycling technology. From June 2011 until October 2012, Mr. Mir was Chairman and Chief Executive Officer of Genetic Immunity, Inc., a plasmid, DNA company in the By-Laws are all available on our website atwww.calmaretherapeutics.com/investors/governance.html.HIV space. From November 2008 until May 2011, Mr. Mir served as Executive Director of Advaxis, Inc., (OTCQB: ADXS), a vaccine biotechnology company. Over the last ten years, he was responsible for raising more than $40 million in growth capital and broadening corporate reach to new investors and current shareholders. Mr. Mir has worked for several investment banks including Sanford C. Bernstein, First Liberty Investment Group, and Nomura Securities International. He holds a BS/BA in Economics and English with special concentrations in Mathematics and Physics from New York University.

Thomas P. Richtarich, 65, Chief Financial Officer, joined the Company in January 2016. Mr. Richtarich has held roles in corporate financial management for public and privately held companies for over twenty years. Prior to joining CTI, Mr. Richtarich has run his own consulting firm, serving as the Chief Financial Officer for his clients and providing assistance to clients in the areas of financial management, strategic planning, capital fund raising, compensation/benefits, talent management and marketing. During 2014 through 2015, Mr. Richtarich served as Director of Finance, Human Resources, and Administration and Chief Financial Officer of ReadMe Systems, Inc., a privately held company, where his efforts led to a revitalization of the company through capital raises and employee recruitment. From 2009 through 2013, Mr. Richtarich served as Director – Human Resources and Administration and Corporate Secretary of TranSwitch Corporation, a public company. During this tenure, Mr. Richtarich managed strategic restructuring, compliance with SEC requirements, benefits programs, and talent acquisition. Mr. Richtarich began his professional career with Southern New England Telephone in various positions in strategic planning, marketing and sales each providing him with progressively increasing management and leadership responsibilities. Mr. Richtarich received his Bachelor of Arts in Political Science from Fairfield University and his Master’s in Business Administration from the University of Connecticut Graduate School of Business.

CORPORATE GOVERNANCE

Board MeetingsIndependence

Three of members of the Board – Rustin Howard, Carl O’Connell, and Stanley Yarbro - are considered to be independent directors.

Board Meetings

The Board currently consists of five members. During fiscal year 2016, the Board met six times. Each director attended not less than 75% of the aggregate number of meetings, and the committees on which they served after becoming a member of the Board or committee.

Committees of the Board

The Board has three committees, with current membership as follows:

| Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||

| Stanley Yarbro | Rustin Howard | |||

| Rustin Howard | Stanley Yarbro | Carl O’Connell | ||

| Carl O’Connell | Rustin Howard | Stanley Yarbro | ||

| Peter Brennan |

During the fiscal year ended December 31, 2014,2016, the board of directors met foursix times.

The Audit Committee held foursix meetings during the fiscal year ended December 31, 2014.2016. The Compensation Committee held one meeting in conjunction with Board Meetingsmeetings in 2014.2016. The Nominating and Corporate Governance committee each held one meeting during fiscal year ended December 31, 2014. In 2014, all directors attended at least 75% of all meetings of the Board of Directors, and the committees on which they served after becoming a member of the Board or Committee.2016. We expect all directors to attend the next Annual Meeting barring unforeseen circumstances or irresolvable conflicts.

Audit Committee

The function of the Audit Committee is to assist the Board in fulfilling its responsibility to the shareholders relating to our corporate accounting matters, financial reporting practices, and the quality and integrity of our financial reports. The Audit Committee’s purpose is to assist the Board with overseeing:

| the reliability and integrity of our financial statements, accounting policies, internal controls and disclosure practices; | ||

| our compliance with legal and regulatory requirements, including our disclosure controls and procedures; | ||

| our independent auditor’s qualifications, engagement, compensation, and independence; | ||

| the performance of our independent auditor; and | ||

| the production of an annual report of the Audit Committee for inclusion in our annual proxy statement. |

The Audit Committee is to be comprised of not less than three independent directors. The Board has determined that each member of the Audit Committee is an independent director in accordance with applicable legal or regulatory requirements. It has also determined that each member is financially literate. Its members have identified Mr. Howard as an audit committee financial expert, as so defined by the US Securities and Exchange Commission (the “SEC”).SEC.

Compensation Committee

The purpose of the Compensation Committee is to:

| review and approve corporate goals and objectives relevant to CEO compensation, evaluate the CEO’s performance in light of those goals and objectives, and determine and approve the CEO’s compensation level based on this evaluation; | ||

| review and approve the compensation of our other officers based on recommendations from the CEO; | ||

| review, approve and make recommendations to the Board with respect to incentive compensation plans or programs, or other equity-based plans or programs, including but not limited to our Annual Incentive Plan, and our 401(k) Plan; and | ||

| produce an annual report of the Compensation Committee on executive compensation for inclusion in our annual proxy statement. |

The Compensation Committee is to be comprised of not less than three of our independent directors. The Board has determined that each member of the Compensation Committee is an independent director in accordance with applicable legal or regulatory requirements.

Nominating and Corporate Governance Committee

The purpose of the Nominating Committee is to:

| identify individuals qualified to become members of the Board, consistent with criteria approved by the Board; | ||

| recommend to the Board, candidates for all directorships to be filled by the Board or our shareholders; | ||

| recommend to the Board, and in consultation with the chairman, which member(s) can and may be appointed to committees of the Board and the chairpersons thereof, including filling any vacancies; | ||

| develop and recommend to the Board a set of corporate governance principles applicable to us; | ||

| oversee, evaluate and monitor the Board and its individual members, and our corporate governance principles and procedures; and | ||

| fulfill such other duties and responsibilities as may be set forth in its charter or assigned by the Board from time to time. |

The Nominating Committee is to be comprised of not less than three independent directors. The Board has determined that each member of the Nominating Committee is an independent director in accordance with applicable legal or regulatory requirements.

The Nominating Committee will consider nominees recommended by shareholders but have not designated any special procedures shareholders need to follow to submit those recommendations. The Nominating Committee has not designated any such procedures because as discussed below under the heading “Shareholder Communications to the Board,with Directors,” shareholders are free to send written communications directly to the Board, committees of the Board, and/or individual directors, at our corporate address in care of our Secretary.

Shareholder Communications to the Board

Shareholders may send communications in writing to the Board, committees of the Board, and/or to individual directors, at our corporate address in care of our Secretary. Written communications addressed to the Board are reviewed by the Chairman of the Board for appropriate handling. Written communications addressed to an individual Board member are forwarded to that person directly.

BENEFICIAL OWNERSHIP OF SHARES

The following information indicates the beneficial ownership of our stock by each director nominee, and by each person known to us to be the beneficial owner of more than 5% of our outstanding stock. The indicated owners, which have sole voting and investment power, have furnished such information to us as of September 16, 2015, except as otherwise indicated in the footnotes.

| Names of Beneficial Owners (and address, if ownership is more than 5%) | Amount Beneficially Owned | (1) |

Percent | (2) | ||||

| Director nominees | ||||||||

| Peter Brennan | 3,788,596 | (3)(4) | 12.3 | |||||

| Rustin Howard | 153,255 | (3)(6) | * | |||||

| Conrad Mir | 600,000 | (3)(7) | 2.1 | |||||

| Carl O’Connell | 15,625 | (3)(8) | * | |||||

| Stan Yarbro | 273,480 | (3)(5) | 1.0 | |||||

| Robert Conway | 0 | * | ||||||

| Steve Roehrich | 0 | * | ||||||

| Director nominees total: | 4,830,956 | 17.0 | ||||||

| Five percent beneficial owners | ||||||||

| Joseph M Finley(9) | ||||||||

| Suite 2300, 150 South Fifth St., Minneapolis, MN 55402 | 1,621,153 | 5.6 | ||||||

Bard Associates, Inc.(10) 135 South LaSalle Street, Suite 3700 Chicago, IL 60603 | 3,750,025 | 12.6 | ||||||

| William Austin Lewis IV(11) | 10,840,493 | 28.5 | ||||||

| 500 5th Avenue, Suite 2240, New York, NY 10110 | ||||||||

* Less than 1%

(1)Designated person or group has sole voting and investment power.

(2)Pursuant to SEC Rule 13d-3, amounts shown include common shares that may be acquired by a person within 60 days of September 16, 2015. Therefore, the column titled “Percent (%)” has been computed based on (a) 28,395,880 common shares actually outstanding as of September 16, 2015; and (b) solely with respect to the person whose Rule 13d-3 Percentage Ownership of common shares is being computed, common shares that may be acquired within 60 days of September 16, 2015 upon exercise of options, warrants and/or convertible debt held only by such person.Corporate Governance

(3)Persons listed below haveThe Company’s Corporate Governance Principles, Corporate Code of Conduct, the right to acquireCommittee Charters for the listed numberAudit Committee and the Nominating and Corporate Governance Committee of shares upon exercisethe Board of stock options:

| Directors, | ||||

(4)Peter Brennan is the beneficial ownerunofficial restated Certificate of Damel Diversified LP, Damel Partners LP,Incorporation and Lisl Brennan Family Trust 2005. Peter Brennan beneficially owns 1,408,386 shares (including the 40,000 stock options referenced in footnote 3 above) and has the right to acquire an additional 2,379,981 shares upon conversion of $2,498,980 of convertible debt.

(5)Stan Yarbro beneficially owns 178,242 shares (including the 40,000 stock options referenced in footnote 3 above) and has the right to acquire an additional 95,238 shares upon conversion of $100,000 of convertible debt.

(6)Rustin Howard beneficially owned 63,255 shares and has the right to acquire 90,000 shares upon exercise of stock options referenced in footnote 3 above.

(7)Conrad Mir has the right to acquire 600,000 shares upon exercise of stock options referenced in footnote 3 above.

(8)Carl O’Connell beneficially owns 3,125 shares and has the right to acquire 12,500 shares upon exercise of stock options referenced in footnote 3 above.

(9)Information is basedBylaws are all available on a Schedule 13GA filed with the SEC on February 6, 2015. Joseph Finley beneficially owns 1,087,613 shares and has the right to acquire an additional 185,714 shares upon the exercise of stock warrants and 347,826 shares upon conversion of $80,000 of convertible debt.

(10)Information is based on a Schedule 13GA filed with the SEC on March 16, 2015. Bard Associates beneficially own 2,500,025 shares and has the right to acquire an additional 1,250,000 shares upon the exercise of stock warrants.

(11)William Austin Lewis IV beneficially owns 1,177,500 shares and has the right to acquire 5,705,884 shares upon conversion of $1,192,352 of convertible debt and 3,957,109 shares upon the exercise of stock warrants.

On September 16, 2015, the stock transfer records maintained by us with respect to our Preferred Stock showed that the largest holder of 5% Preferred Stock owned 500 shares; the largest owner of Class C Convertible Preferred Stock owned 375 shares. No directors own Preferred Stock. website atwww.calmaretherapeutics.com/investors/governance.html.

BENEFICIAL OWNERSHIP REPORTING CERTAIN RELATIONSHIP AND RELATED TRANSACTIONS

As of December 31, 2016, and December 31, 2015, the Company has $431,300 and $308,400, respectively, owed in fees to current directors, which are accounts payable.

As of December 31, 2016, and December 31, 2015, $2,598,980 of the outstanding notes payable were payable to related parties; $2,498,980 to the Chairman of our Board, Peter Brennan, and $100,000 to another director, Stan Yarbro. Accrued interest on these Notes, which are in categorized as accrued liabilities, was $615,000 and $28,000, respectively as of December 31, 2016, and $465,000 and $22,000, respectively, as of December 31, 2015. In addition, the Company has recorded additional interest on Mr. Brennan’s Notes, pending negotiations, of $1,432,000 as of December 31, 2016, and $1,007,000 as of December 31, 2015.

On September 15, 2015, the Company announced the appointment of Stephen J. D’Amato, M.D. as chief medical officer of the Company. During 2010, Calmar Pain Relief, LLC, purchased 10 Calmare devices from the Company for an aggregate purchase price of $550,000. Additionally, during 2016 and 2015, Calmar Pain Relief purchased certain supplies from the Company totaling $3,200 and $1,900, respectively. Dr. D’Amato is one of the managing members of Calmar Pain Relief, LLC.

On October 15, 2015, the Company entered into a consulting agreement with VADM Robert T. Conway, Jr., U.S. Navy, (Ret) (the “Admiral”), a former member of the Company’s Board of Directors. The agreement is for one year and includes compensation of a monthly retainer fee of $7,500 and a five-year warrant to purchase 167,000 shares of common stock of the Company, fully vested on the date of issuance, at a strike price of $.60 per share. As a result of this agreement, the Board of Directors determined that the Admiral is no longer an independent director of the Company. On January 19, 2017, the Admiral resigned from the Board of Directors. As of January 19, 2017, the Company has $30,000 in consulting fees payable to the Admiral.

COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that our directors and executive officers and persons who beneficially own more than five percent10% of our common stock (referred to herein as the Common Stock to“reporting persons”) file reports of ownership and changes in ownership with the SEC various reports as per that appropriate SEC regulation(s) that requireto their ownership of and activities relating to our common stock. Such reporting persons are required by the SEC regulations to furnish us with copies of all Section 16(a) formsreports they file.

Based solely onupon a review of copies of Section 16(a) reports and representations received by us from reporting persons, and without conducting any independent investigation of our own during the fiscal year ended December 31, 2016, all such reports received or written representations from certain reporting persons, we believe all reporting persons complied with all applicable reporting requirements. were timely filed.

DIRECTOR STOCKHOLDER COMMUNICATIONS WITH DIRECTORS

Stockholders and other interested parties may send correspondence by mail to the full Board or to individual directors. Shareholders should address such correspondence to the Board or the relevant Board members in care of: Calmare Therapeutics Incorporated, 1375 Kings Hwy., Suite 400, Fairfield, CT 06824, Attention: Secretary.

All such correspondence will be compiled by our Secretary and forwarded as appropriate. In general, correspondence relating to corporate governance issues, long-term corporate strategy or similar substantive matters will be forwarded to the Board, one of the committees of the Board, or a member thereof for review. Correspondence relating to the ordinary course of business affairs, personal grievances, and matters as to which we tend to receive repetitive or duplicative communications are usually more appropriately addressed by the officers or their designees and will be forwarded to such persons accordingly.

COMPENSATION DISCUSSION AND ANALYSIS

We have a standing Compensation Committee on our Board. Our President, or in the absence of a President, our Chief Executive Officer, makes recommendations to the committee as to employee benefit programs and officer and employee compensation. The Company’s compensation program consists of base salary, bonus, stock options, other incentive awards and other benefits, which the Committee generally reviews annually. The Committee’s overall philosophy is to align compensation with our business strategy and to support achievement of our long-term goals. In order to attract and retain competent executives, we believe it is essential to maintain an executive compensation program that provides overall compensation competitive with that paid to executives with comparable qualifications and experience. The Committee annually reviews all compensation plans to assure effectiveness and fiduciary responsibility.

Components of Compensation Program

Annual Base Salary.The Company provides officers and other employees with base salary to compensate them for services rendered during the fiscal year. Base salary ranges for officers are determined for each executive based on his or her position and responsibility using (i) market data, (ii) an internal review of the executive’s compensation, both individually and relative to other executive officers, and (iii) the individual performance of the executive.

Incentive Stock Options. In August 2016, the Board approved the 2016 Stock Option Plan. This Plan gives the Board the capability to promote high performance and achievement of corporate goals by all employees, encourage the growth of shareholder value, and allow all employees to participate in the long-term growth and profitability of the Company. At the Company’s Annual Meeting on November 9, 2016, the proposal to approve the 2016 Stock Option Plan did not receive the affirmative vote of a majority of outstanding shareholders. No options were issued in 2017. In 2018, the Board will consider the adoption of a 2018 Stock Option Plan.

Annual Cash Bonus. In addition to the competitive annual base salary, we intend to reward executive officers each year for the achievement of specific goals, which may be financial, operational or technological. We consider objectively measurable goals, such as obtaining new investment capital, negotiating valuable contracts and achieving research and regulatory milestones, and more subjective goals, such as quality of management performance and consistency of effort. The Company’s objectives include operating, strategic and financial goals the board considers critical to the Company’s overall goal of building shareholder value. Our recommendations for cash bonuses also take into account the Company’s liquidity and capital resources in any given year.

In August 2015, the Compensation Committee of the Board of Directors reviewed the performance of the Chief Executive Officer over the previous 18 months. Based on this performance, the Committee, which included Stanley Yarbro, recommended that the Board award the Chief Executive Officer 40% of the allowable bonus, which amounted to $53,000. The Committee, which included Stanley Yarbro, also recommended that the Board extend the contract of the Chief Executive Officer until September 30, 2016. Both recommendations were approved by the Board, which included two of the Minority Complaining Stockholders: Robert Conway and Stanley Yarbro.

In November 2016, the Compensation Committee of the Board of Directors reviewed the performance of the Chief Executive Officer over the previous 18 months. Based on this performance, the Committee, which included Stanley Yarbro, recommended that the Board award the Chief Executive Officer 20% of the allowable bonus, which amounted to $54,000. The Committee, which included Stanley Yarbro, also recommended that the Board extend the contract of the Chief Executive Officer. Both recommendations were approved by the Board.

Benefits. The Company provides executive officers with retirement and other personal benefits. These include medical, dental, vision, life, AD&D, short-term disability and long-term disability insurance, as well as a Company sponsored 401(k) plan. The Committee believes that these benefits are reasonable and consistent with its overall compensation program to better enable the Company to attract and retain superior employees for all positions. Officers are eligible to receive the same health and welfare benefits that are generally available to other employees and they contribute to their benefit premium on the same terms as other employees under the same plan and level of coverage.

Assessment of Risk. In the design of executive compensation plans, the Committee considers the desired behavior the Committee wants to incent and how that behavior relates to increasing shareholder value. The Committee does not feel that there are any compensation-related risks that are reasonably likely to have a material effect on the Company.

The annual base salaries and annual cash bonus targets for our current executive officers are shown in the table below.

| Executive Officer | Annual Base Salary | Cash Bonus Target |

| Conrad F. Mir | $270,000 | 100% |

| Thomas P. Richtarich | 150,000 | 40% |

* Mr. Mir has deferred and accrued a total of nine and a half months of salary that has not been paid by the Company.

** Mr. Richtarich has deferred and accrued a total of nine and a half months of salary that has not been paid by the Company so as not to burden the Company.

The following table summarizes the total compensation awarded to, earned by or paid by us for services rendered by the 4 highest paid ($100,000 or more) employees that served during the years ended December 31, 2016 and December 31, 2015.

Name and Principal Position | Year ended | Salary | Bonus | Option Awards(4) | All Other | Total | ||||||||||||||

| Conrad F. Mir(1)* | 12/31/2016 | $ | 225,000 | $ | 54,000 | $ | $ | 279,000 | ||||||||||||

| Director, President and Chief Executive Officer | 12/31/2015 | $ | 270,747 | $ | 53,000 | $ | $ | 323,747 | ||||||||||||

| Thomas P. Richtarich(2)** | 12/31/2016 | $ | 113,017 | $ | 113,017 | |||||||||||||||

| Chief Financial Officer | ||||||||||||||||||||

| Ian Rhodes(3) | ||||||||||||||||||||

| Former Executive Vice President | 12/31/2015 | $ | 146,689 | $ | 146,689 | |||||||||||||||

| and Chief Financial Officer | $ | |||||||||||||||||||

| (1) | Mr. Mir joined the Company in September 2013. |

| (2) | Mr. Richtarich joined the Company in January 2016. |

| (3) | Mr. Rhodes joined the Company in May 2014 and resigned as Chief Financial Officer in January 2016. |

| (4) | The amounts shown in this column indicate the grant date fair value of option awards granted in the subject year computed in accordance with FASB ASC Topic 718. The assumptions made in the valuation of these options can be found in Note 14 to our financial statements included in our 2015 Form 10-K. |

Grants of Plan-Based Awards

During the quarter ended December 31, 2013, the Company granted 1,000,000 options to Conrad Mir. As approved by the Board which included one of the Minority Complaining Stockholders (Stanley Yarbro), these options vest over a four (4) year period, with 200,000 options vested upon issuance.

During the quarter ended June 30, 2014, the Company granted 300,000 options to Ian Rhodes. As approved by the Board, these options granted were expected to vest over a four (4) year period, with 60,000 options vested upon issuance. Upon his resignation on January 8, 2016, the 180,000 unvested options were forfeited. Additionally, the 120,000 vested options all expired 90 days from his resignation, per the Option Agreement.

Outstanding Equity Awards at December 31, 2016

| Name | Number of Securities Underlying Unexercised Options Exercisable(1) | Number of Securities Underlying Unexercised Options Unexercisable(1) | Option Price | Option Expiration Date | ||||||||||

| Conrad Mir | 1,000,000 | 0 | 0.08 | 10/1/18 | ||||||||||

(1)Option awarded under the 2011 Employees’, Directors’ and Consultants’ Stock Option Plan, with one of the Minority Complaining Stockholders (Stanley Yarbro) voting to approve the options.

Director Compensation

Each of our non-employee directors is paid an annual cash retainer of $10,000, paid quarterly in arrears, for their services to the Company. In addition, directors are issued shares of common stock pursuant to our 1996 Directors Stock Participation Plan, as amended, and are granted stock options to purchase common stock pursuant to our 2011 Employees’ Directors’ and Consultants’2000 Directors Stock Option Plan, as amended, both as described below. In addition, the Chairman of the Board, if a non-employee, is paid fees for the additional responsibilities and time commitments required of him. These fees are equal to an additional $5,000 cash retainer, in addition to the amount noted above and an additional $500 for each Board meeting attended.

Each non-employee director is also paid $1,000 for each Board meeting attended and $500 for each committee meeting attended. All directors are reimbursed for out-of-pocket expenses incurred to attend Board and committee meetings.

On the first business day of January, each non-employee director who had been elected by the stockholders and had served at least one full year as a director, wasis issued a number of shares of common stock equal to the lesser of $15,000 divided by the per share fair market value of such stock on the issuance date, or 2,500 shares. If a non-employee director were to leave the Board after serving at least one full year, but prior to the January issuance date, we will issue shares of common stock to the director on a pro-rata basis up to the termination date.

Non-employee directors were granted 10,000 fully vested, non-qualified stock options to purchase our common stock on the date the individual was first elected as a director, whether by the stockholders or by the Board, and waswere granted 10,000 options on the first business day of January thereafter, provided the individual was still a director. The stock options granted were at an exercise price not less than 100% of the fair market value of the common stock at the grant date and had a term of five (5) years from date of grant; options granted under earlier, now expired plans had ten year terms. If an individual’s directorship terminated because of death or permanent disability, the stock options may be exercised within one year after termination. If the termination was for any other reason, the stock options may be exercised within 180 days after termination. However, the Board had the discretion to amend previously granted stock options to provide that such stock options may continue to be exercisable for specified additional periods following termination. In no event may a stock option be exercised after the expiration of its term.

Three of the Minority Complaining Stockholders (Stanley Yarbro, Robert Conway, and Steven Roehrich) have been participants in these plans for cash fees and stock options without any objection. Mr. Mir has not participated in these plans.

The following table summarizes the total compensation awarded to, earned by or paid by us for services rendered during fiscal yearyears ended December 31, 2014,2016 and December 31, 2015, to the non-employee Board of Director members:

| Name | Fees Earned or Paid in Cash(1) | Option Awards (2) | Other Equity Compensation(3) | Total | Year Ended | Fees Earned or Paid in Cash(1) | Option Awards(2) | Other Equity Compensation(3) | Total | |||||||||||||||||||||||||

| Peter Brennan(4) | $ | 22,500 | $ | 1,589 | $ | 425 | $ | 24,514 | 12/31/2016 | $ | 22,500 | $ | $ | 475 | $ | 22,975 | ||||||||||||||||||

| 12/31/2015 | $ | 18,000 | $ | $ | 475 | $ | 18,475 | |||||||||||||||||||||||||||

| Robert T. Conway, Jr.(5) | 12/31/2016 | $ | 15,000 | $ | $ | 475 | $ | 15,475 | ||||||||||||||||||||||||||

| 12/31/2015 | $ | 3,500 | $ | $ | 475 | $ | 3,975 | |||||||||||||||||||||||||||

| Rustin Howard | $ | 17,000 | $ | 1,589 | $ | 425 | $ | 19,014 | 12/31/2016 | $ | 21,000 | $ | $ | 475 | $ | 21,475 | ||||||||||||||||||

| Robert G. Moussa | $ | 16,000 | $ | 1,589 | $ | 425 | $ | 18,014 | ||||||||||||||||||||||||||

| 12/31/2015 | $ | 15,000 | $ | $ | 475 | $ | 15,475 | |||||||||||||||||||||||||||

| Carl O’Connell | $ | 12,000 | $ | 1,589 | 425 | $ | 14,014 | 12/31/2016 | $ | 16,000 | $ | $ | 475 | $ | 16,475 | |||||||||||||||||||

| 12/31/2015 | $ | 12,000 | $ | $ | 475 | $ | 12,475 | |||||||||||||||||||||||||||

| Steven Roehrich(6) | 12/31/2016 | $ | 20,000 | $ | $ | 475 | $ | 20,475 | ||||||||||||||||||||||||||

| 12/31/2015 | $ | 10,000 | $ | $ | 475 | $ | 10,475 | |||||||||||||||||||||||||||

| Stan Yarbro, Ph.D. | $ | 23,400 | $ | 1,589 | $ | 425 | $ | 25,414 | 12/31/2016 | $ | 28,400 | $ | $ | 475 | $ | 28,875 | ||||||||||||||||||

| 12/31/2015 | $ | 21,400 | $ | $ | 475 | $ | 21,875 | |||||||||||||||||||||||||||

1)(1) In 2015, Mr. Roehrich, one of the Minority Complaining Stockholders, received $10,000 in cash. No other cash payments were made to directors for fees during 2015. No cash payments were made to Directorsdirectors for fees during 2014.2016.

2)(2)Each In August 2016, each director serving on January 2, 20152016 received a stock option for 10,000 shares of common stock for services rendered during 2014 in January 2015 at $0.159$0.1427 per share under the 2011 Directors2016 Stock Option Plan approved by the Board of Directors in May 2011. We estimatedAugust 2016. Because the fair value of2016 Stock Option Plan was not approved by the stockholders at the Company’s Annual Meeting in November 2016, these options were cancelled. No stock awards at $0.159 per share usingoptions were awarded to Directors in 2017 for services rendered in the Black-Scholes option valuation model with expected life of 5 years, risk free interest rate of 1.61%, volatility of 164.53% and dividend yield of 0.prior year.

3)Each director serving on January 2, 20152016 received 2,500 shares of common stock for services rendered during 2014.2015. The fair market value of the stock was $0.17$0.19 per share. Each director serving on January 2, 2017 received 2,500 shares of common stock for services rendered during 2016. The fair market value of the stock was $0.19 per share.

4)(4)Mr. Brennan has served as Chairman since May of 2012.

(5)Mr. Conway resigned as a Director on January 19, 2017.

(6)Mr. Roehrich resigned as a Director on January 19, 2017.

Outstanding Equity Awards at January 2, 2015December 31, 2016 to Non-Employee Directors